[F12]Recursos - ¿Cómo calcular cuánto cobraré cuando llegue la jubilación?

Recursos - ¿Cómo calcular cuánto cobraré cuando llegue la jubilación?

How can I calculate how much I will receive when I retire?

Retirement is just around the corner, but you still do not know how much you are going to receive when the time comes. Don't worry, it is normal to have questions. Calculating your retirement pension can seem like a puzzle.

At VidaCaixa, we give you the tools and information you need to accurately calculate the final amount you will receive when your retirement day arrives. Get ready to take control of your financial future!

Do you want to know how to calculate your pension? It all depends on 3 factors

Your state pension benefit is based on three factors: your age, the number of years of contributions to the Social Security system and the contribution rate. Making an approximate calculation of how much you will be paid when you retire is the first step in setting a savings goal that will allow you to retain your standard of living over this new stage:

So, as you can see, it all comes down to three factors. The first is the retirement age, which in Spain has been gradually increasing from 65 and is set to reach 67 by 2027. The second factor is the number of years of contributions to the Social Security system. To claim a 100% pension benefit, you need to have contributed for more than 38 years and 3 months (38 years and a half by 2027). And the third factor is the contribution rate. This is the remuneration on which the pension is calculated.

How to calculate your retirement pension: All the key factors

To determine the exact amount of your retirement pension, you need to consider what is referred to as the reference value of the payroll, applying percentages based on years of contributions and additional factors such as the extension of the working life or the reduction coefficients in the case of early retirement.

The base rate for the retirement pension from 2022 is calculated by dividing your contribution bases by 350 during the 300 months prior to retirement, as the 12 months of each of the last 25 years of working life are taken into account.

In addition, the percentage applied to calculate contributory pensions varies depending on the years of Social Security contributions, with specific adjustments for different periods and special considerations for maternity and the gender gap:

Percentage of years contributed as of 01-01-2013

- Starts at 50% after 15 years of contributions (180 months).

- Increases by 0.21% per additional month between the 16th and 163rd month, then by 0.19% per month until month 248.

- After month 248, the increase falls to 0.18%.

- A coefficient is applied to adjust the percentage.

- A sustainability factor is introduced, which was initially due to come into effect in 2023, but has been postponed..

Percentage of years contributed in the transitional period up to 2027

- Until 2027, there is a transitional period with specific percentages.

- The transitional maintenance of the maternity supplement for those who received it in 2021.

- A new supplement is introduced to reduce the gender gap, replacing the maternity supplement.

Percentage of years contributed for legislation prior to 01-01-2013

- Starts with 50% at 15 years.

- Increases by 3% for each additional year between the 16th and 25th years.

- It then increases by 2% for each additional year until it reaches 100% at 35 years.

Regulatory base of the contributory retirement pension

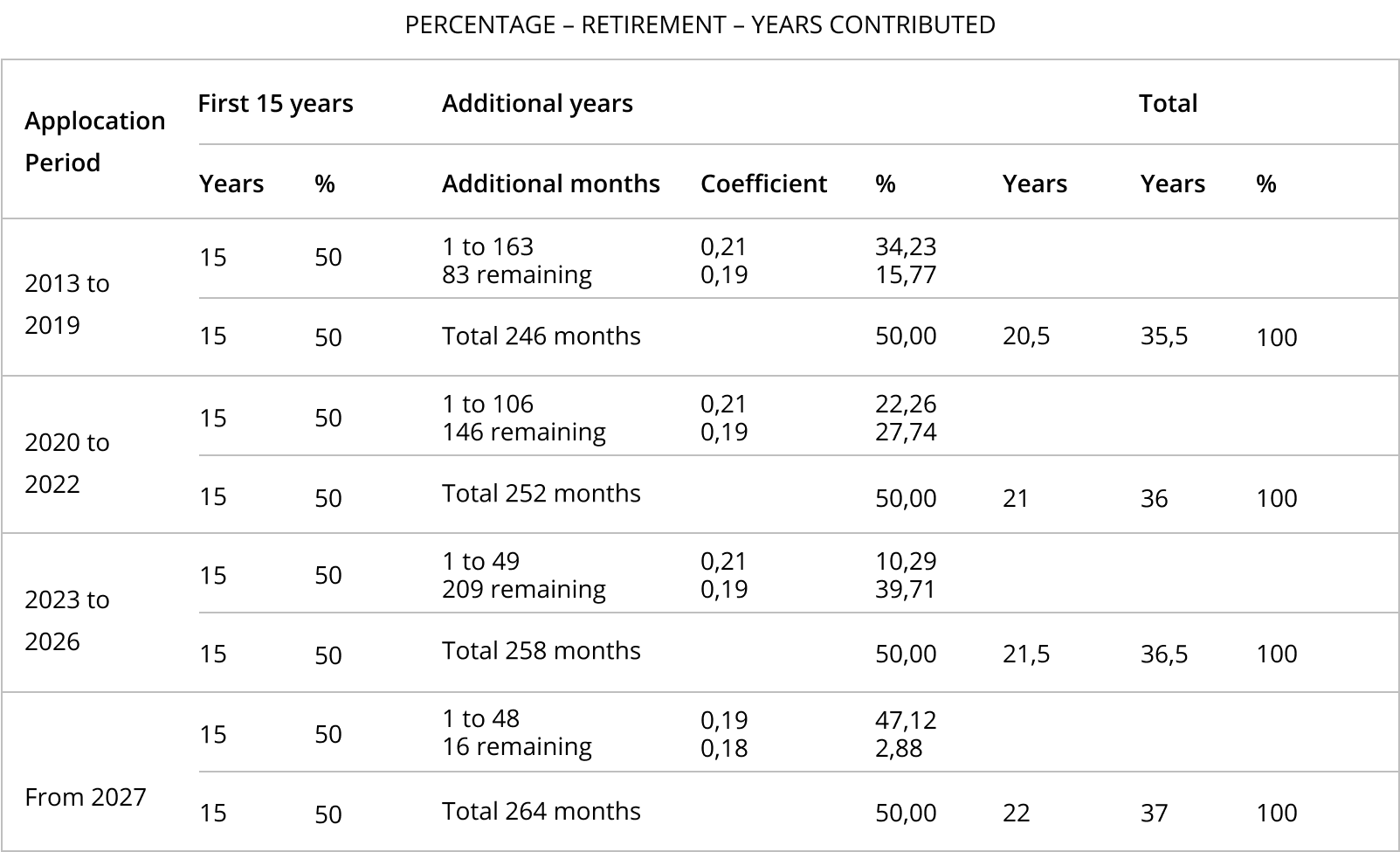

The following table shows in greater detail the percentages of the retirement pension that will be received depending on the years of contributions during the transitional and gradual period that has been established until the year 2027:

Source: Social Security

How much will I get when I retire?

As we have already mentioned, the percentage of the retirement pension to be received varies depending on the number of years of Social Security contributions, applying a scale that starts at 50% after 15 years, increasing by certain percentages depending on the legislation applicable to the person who is going to retire.

Moreover, if you still have any questions about how to calculate your retirement pension, Social Security provides a retirement simulator that allows you to calculate the approximate amount you will receive, as well as future situations, taking into account the data and contributions you have made up to the present day.

How much will I get for my pension if the result is more or less than the statutory amount?

In 2025, retirement pensions in Spain have increased by 2.8%, as they are linked to the CPI and inflation. This increase applies to both minimum and maximum pensions.

As a result, the maximum retirement pension now stands at €3,267.60 per month, while the minimum pension is €548 per month. However, if the calculated pension amount exceeds or falls below the established limits, certain adjustments will be applied to the final amount.

Currently, in Spain, only 4.2% of pensioners receive the maximum pension. However, more than half of pensioners in Spain receive a pension lower than the Minimum Wage (known in Spain as the “Salario Mínimo Interprofesional” or SMI).

When calculating the retirement pension, the amount could be higher or lower than the legally established limit. In situations where the pension is lower, such as in the case of part-time or low-paid workers, the state may intervene and cover the difference with supplements up to the legal minimum. For 2025, the minimum retirement pension has increased by 6%, standing at €548 per month.

However, if the calculated retirement pension exceeds the legal maximum of €3,267.60 per month in 2025, the excess amount will be forfeited.

These minimum supplements are reviewed annually and there is a reporting obligation if pensioners exceed the minimum limit during the year.

Discover the ideal savings scheme for your future

If you are worried about your future, calculate how much you will get when you retire. It is important to know how much you will have for your retirement in order to decide if you need to set up a private savings scheme to improve your retirement prospects. Ask for advice at your local CaixaBank branch and we will help you find the best solution for your needs.

Categorías relacionadas - titulo

Categorías relacionadas - carrusel - planes de pensiones - seguros vida - seguros ahorro

[TEXTO SEO]- PREGUNTAS FRECUENTES

Asset Publisher

-

How much should I save every month for my retirement?

-

There isn’t a specific amount to save, but we do advise you to put aside at least 10% of your monthly salary and go increasing it as your salary rises over time.

-

-

What should I do to have a good pension pot?

-

People often ask themselves what to do to have a good pension pot, but there isn’t a specific guide for this. What you really need is the help of an expert advisor or to draw up a plan with a pension scheme early on. We advise you to get going early on. So how do you prepare for your retirement? Some tips are first thinking about how you'd like to live when you retire. Estimate how much pension you’ll receive from the government, taking into account important factors like inflation and your return or risk profile. Look into pension schemes and set up the one that best fits your needs and persevere and be patient to avoid touching the nest egg you’re building for your retirement.

-

-

How long do I need to contribute to the Social Security institution to get 100% of my pension?

-

It depends on how old you are when you retire and the contributions made to the Social Security system during your working life. The retirement age in Spain will increase gradually until 2027, when it will be 67 years. In 2025, the retirement age is 66 years and 8 months if you want to receive 100% of your pension.

-

-

What will happen if I become unemployed or my business closes down?

-

There’s the option of paying the contributions yourself through special agreements with the Social Security authorities to keep being entitled to your pension. Ask one of our advisors or staff members.

-

-

How is the widow/widower’s pension stipulated?

-

The deceased must have been registered with the Social Security institution and paying contributions to it for a certain time. The calculation basis depends on the deceased’s situation (active worker or pensioner) and the cause of their death (common contingency or workplace contingency). Feel free to ask for advice.

-

-

When should I start saving up for my retirement?

-

There isn’t a specific age to start saving up for your retirement. But there is a maximum age accepted and recommended by any advisor: the sooner you start, the better, because it will require far less effort. Therefore, as soon as you have some savings capacity, like for example at 30, you should start saving up or even before if possible.

-

-

How can I retire at 55?

-

Generally speaking, you can’t retire at 55, as you need to reach the minimum age to be entitled to a forced retirement pension, which is four years before the legal retirement age.

-

-

How to get the best pension possible?

-

Firstly, you have to take into account your age, savings and income. We advise you to bear in mind all the keys to getting the best pension possible. Age is a determining factor in receiving your retirement pension, based on the number of years you’ve been paying contributions to the Social Security institution and the increased minimum age. As we know, the higher life expectancy has also meant an increase in the number of years you will be receiving said pension. Also, putting some money aside every month, as if it were a fixed expense, will be essential to build a nest egg that will add to your pension. With time and perseverance, you’ll be able to make those savings work for you and get the best return possible.

-

-

How do I know if I’m entitled to a pension?

-

In order to be eligible for a pension, you must have paid contributions to the Social Security institution and have been working for the minimum time set to receive a pension. You can ask for this information online, through the Social Security website.

-

VidaCaixa Form

Subscribe to our newsletter

You will learn to enjoy the future without worries.