VidacaixaCorporativoBuscadorHeader

Breadcrumb

[F12] Recursos - La guía definitiva sobre la jubilación en España: todo lo que necesitas saber (2024)

Recursos - La guía definitiva sobre la jubilación en España: todo lo que necesitas saber (2024)

The definitive guide to retirement in Spain: everything you need to know (2025)

Some people are counting down the years to retirement, while others want to delay it as long as possible. It doesn’t matter! Retirement, whenever it may be, is a new stage in life and you need to be ready for it. The first step is to think ahead and save. After that, there are lots of other things to think about.

When facing this new stage, you have to take into account the latest changes and developments in pensions, the requirements to claim a pension, how to apply for your pension and how to supplement the pension benefit, among other key questions. At VidaCaixa, we make it easy for you with the definitive guide to retirement in Spain.

Latest changes in retirement in 2025

Minimum and non-contributory pensions grow in 2025. Spending on contributory pensions reached a new record last year, hitting €200 billion, and will continue to rise due to pensions being increased in line with inflation and the retirement of the baby boom generation, the largest demographic group which is now reaching retirement age.

The Consumer Price Index (CPI) figures published by the Spanish Statistical Office (INE) can be used to calculate how much contributory pensions will increase by in 2025, since under the pension reform, annual pension increases are now directly linked to inflation. As a result, pensions will rise by 2.8%, with contributory pensions ranging from €874 for minimum pensions to €1,441 for average pensions, and up to €3,267 for maximum pensions.

One of the key changes to retirement in 2025 is the increase in the retirement age, which is set to reach a minimum retirement age of 67 years by 2027. Compared to 2024, there is a further adjustment. Those who have contributed 38 years and 3 months can still retire at 65. However, those who have not reached this threshold will have to wait until they turn 66 years and 8 months to retire.

Requirements for retirement in 2025

As a general rule, anyone retiring at the legal age at any given time must meet the following requirements:

- Be of the legal retirement age. In Spain, this age has been rising slowly but steadily for more than ten years. This process will end in 2027. In 2025, the legal retirement age for ordinary retirement has increased by two months compared to the previous year, reaching 66 years and 8 months for those with less than 38 years of contributions. However, those who have accumulated 38 years and 3 months or more of contributions, can still retire at 65 years.

- Meet the minimum required contribution period. The minimum contribution period in 2025 remains the same as in 2023. You need to have paid 36 and a half years of contributions, of which at least 2 must have been paid in the last 15 years.

Additional pension measures in 2025

In addition to changes in contribution bases and retirement age, new measures are being introduced in 2025 to enhance the sustainability of the public pension system. Among the key initiatives are:

- Individual pension savings accounts to encourage workers to create personal savings accounts where they can make voluntary contributions to supplement their retirement income.

- Increase in contributions for the self-employed, with the introduction of new contribution brackets, to reflect actual earnings, aiming to reduce pension disparities between employees and the self-employed.

- Enhancing the gender gap supplement, which in 2025 will see an additional 10% increase on top of the annual pension adjustment for women who have had interrupted careers or lower earnings.

Early voluntary retirement

On the other hand, those who wish to apply for early voluntary retirement, meaning the option to retire two years before the official retirement age, will be able to do so in 2025, provided they have reached the age of 64 years and 8 months.

It is important to note that choosing this option comes with percentage reductions applied to the future monthly pension amount. The reduction coefficients applied to the pension will depend on the number of months by which retirement is brought forward.

Retirement age: How can you retire early?

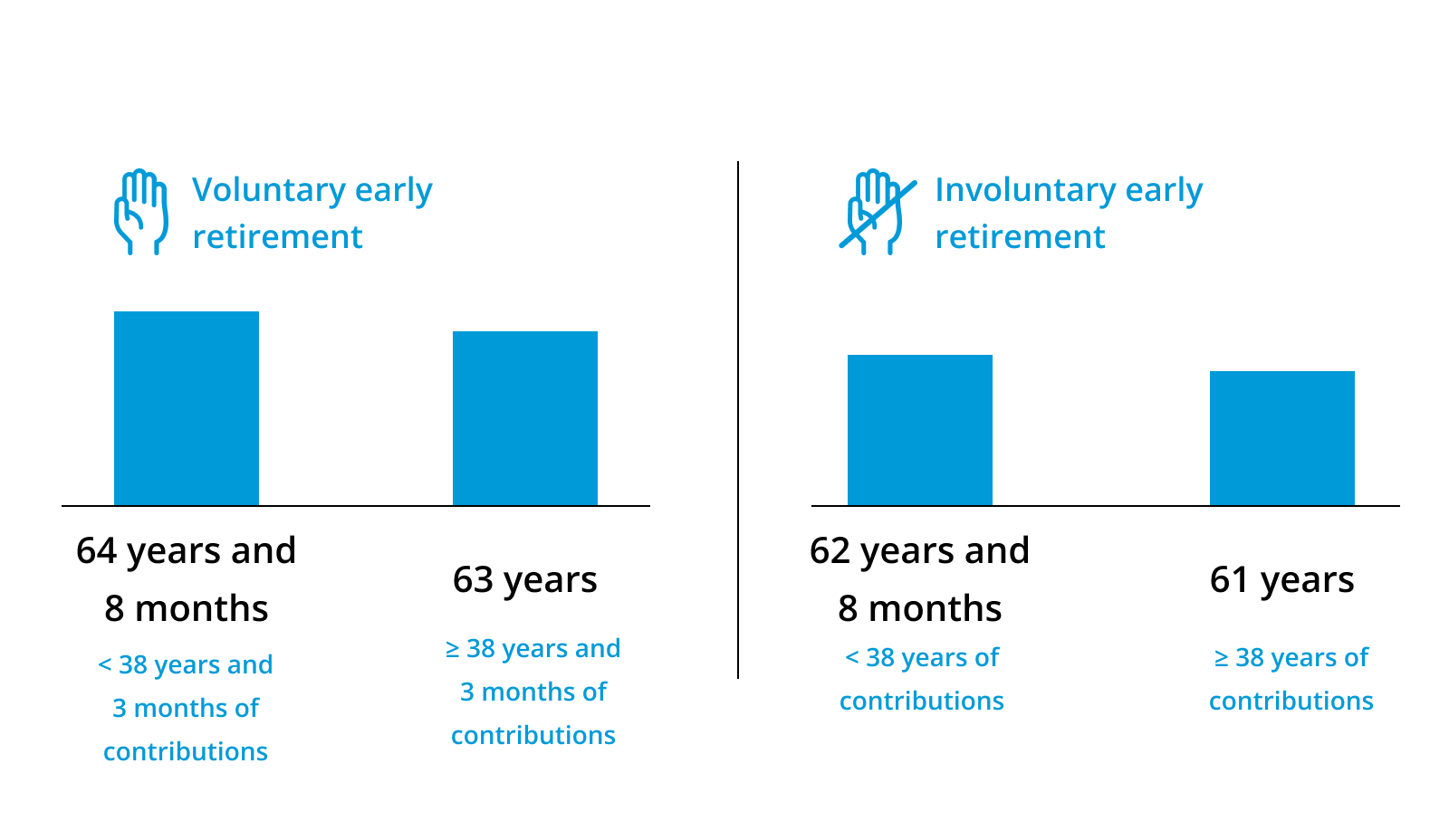

As mentioned above, you need to reach retirement age before you can draw a pension. Voluntary early retirement is possible up to 2 years before the normal retirement age. In the case of involuntary or forced early retirement, you can take early retirement up to 4 years before the normal age.

- Therefore, in order to take voluntary early retirementin 2025, you must be at least 64 years and 8 months old if you have less than 38 years and 3 months of contributions. If you have 38 years and 3 months or more of contributions, you can take early voluntary retirement from the age of 63.

- In the case of involuntary early retirement, in 2025 it will be possible to take forced early retirement from the age of 62 years and 8 months if you have less than 38 years of contributions, or from the age of 61 if you have made 38 years or more of contributions.

Types of retirement: partial or flexible?

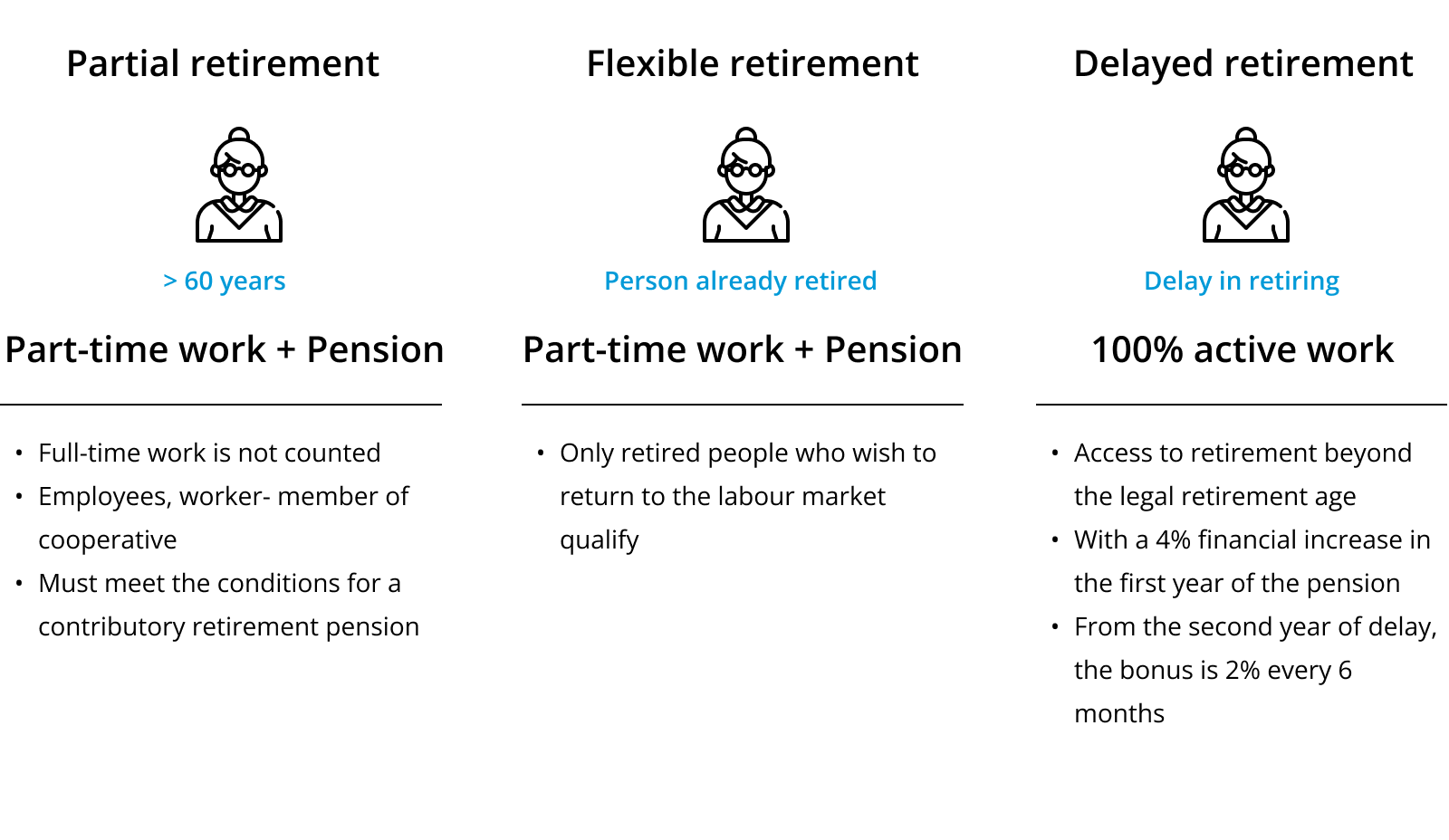

Partial retirement is the most traditional way of combining work and pension. This type of retirement after the age of 60 happens while still having an employment contract or linked to a relief contract with another unemployed worker:

- It is not possible to combine a full-time job with drawing a pension.

- You are entitled to this type of pension if you are an employee or a worker-member of a cooperative and meet the conditions for a contributory retirement pension.

- There are two ways to qualify for partial retirement: with or without a relief contract. In other words, you can opt for a part-time contract or a full-time contract in which an unemployed person partially fills in as a relief worker.

For access to partial retirement with a replacement contract, the following rules apply:

- From 2025, access to partial retirement with a replacement contract will be possible three years before the official retirement age, depending on the contributor’s years of contributions.

- For those who bring forward their retirement by more than two years, the working hours reduction must be at least 20% and no more than 33%.

- The replacement worker must be hired with a permanent full-time contract.

For access to partial retirement without a replacement contract, the following rules apply:

- It is allowed upon reaching the legal age for ordinary retirement, signing a part-time contract with the employer. In this case, no replacement worker is hired.

- The working hours reduction ranges between a minimum of 25% and a maximum of 75% (previously up to 50%).

- To qualify for partial retirement without a replacement contract, a minimum contribution period of 15 years is required, with at least 2 years within the last 15.

Flexible retirement also allows you to combine your pension with a part-time contract, but this is only for people who are already retired and want to return to the labour market. It allows a pension to be received while also having a part-time contract, through a reduction in working hours ranging between 25% and 50%.

There is also so-called deferred retirement, which covers those who decide to remain 100% active and delay retirement. Additionally, they can improve their benefits or receive other advantages applied to the contribution base.

Deferred retirement will come with the benefit of a financial supplement when they eventually retire. The new agreement on retirement and pensions introduces more incentives for workers who extend their working life.

Among these incentives, from the second year of delayed retirement onwards, every six months will increase the pension by 2%, whereas previously the maximum limit was 4%.

Retirement for the self-employed

According to the study ‘Emprende tu jubilación’ (Plan your retirement), conducted by VidaCaixa and the University of Barcelona, the average pension of a self-employed person is half that of an employee. Here are some tips about retirement for the self-employed:

- Self-employed workers must be very aware of their contribution base when planning their retirement.

- The contribution base you choose when making payments to Social Security can be changed six times a year.

- More than 85% of self-employed workers pay the minimum contribution base. This means their pension would not exceed €635 per month, almost 50% of the average pension of an employed person.

- 75% of self-employed workers do not think that the public pension they will receive will be sufficient for them once they retire

- Following the latest pension reform, the self-employed are now eligible for early retirement, although the age is not fixed. Instead, it depends on the normal retirement age at the time of their retirement.

-

In 2025, the standard retirement age for self-employed workers will be 66 years and 6 months, unless they have contributed at least 38 years and 3 months, in which case they can retire at 65 years.

-

To improve their retirement, self-employed workers are advised to supplement their pension with private pension plans or savings and investment products.

How to calculate your retirement pension

The pension situation in Spain is quite tricky, as the ageing population is posing many challenges. The government has had to made adjustments, like gradually pushing back the retirement age and increasing certain taxes to raise funds.

To understand how to calculate your retirement pension and how much you will receive when you retire, you first need to know the numbers to input into the simulation. These include

- The regulatory base. The regulatory base is understood to be the average of contribution you have made during a specific period of time prior to retirement. To calculate the regulatory base you have to take into account the last 25 years, which is 300 months of contributions. Those of the last two years will be calculated at their nominal value, while all previous ones are updated in line with the Consumer Price Index (CPI) throughout that period.

- The percentage of the regulatory base. The worker receives a percentage of the regulatory base according to the number of years they have contributed. To receive 100% of it, from 2027 you will need a total of 37 years of contributions. A minimum of 15 years will be required to earn any pension. With 15 years of contributions, you will be entitled to 50% of the regulatory base. For those who are retiring in 2024, in order to be entitled to 100% of the regulatory base, you need at least 36 years and 6 months of contributions (also applicable for those who retire in 2023, 2025 and 2026).

The pension system is a big challenge, which is why it is vital to plan for your future and your retirement, financially speaking. You can calculate your pension or learn about the products that best suit you and start improving your future straight away.

How to apply for a pension

If you are going to retire, the first thing you need to do is go through all the relevant processes with your company, first giving notice of voluntary resignation due to retirement. This procedure is completed in writing and you can ask for help from advisers and professionals if you are unsure how to prepare it.

The procedure for applying for a retirement pension can be completed on the Social Security Electronic Office website. You can also visit in person, although you must first make an appointment. This procedure can also be carried out on the Social Security Electronic Office website or by downloading the app.

The system provides a locator code, which you will need to use if you return to the procedure, for example to change or cancel an appointment. You must submit the following documents:

- Correctly completed retirement application form.

- National ID (DNI) or Foreigners’ ID (NIE) or passport.

- If someone else is going to attend on your behalf, they must bring proof that they are your legal representative.

How to supplement and improve your pension

Find out how you can supplement your pension and protect yourself for the future. In Spain, saving for retirement is a task that is still on our to-do list, both individually and as a country. For example, only 1% of companies offer employment schemes to their employees.

However, supplementing your pension income is possible and the only trick is to save money. Here, time and consistency are key. However little you save, getting into the habit of saving and giving your money time to grow is vital in reaching your retirement goal.

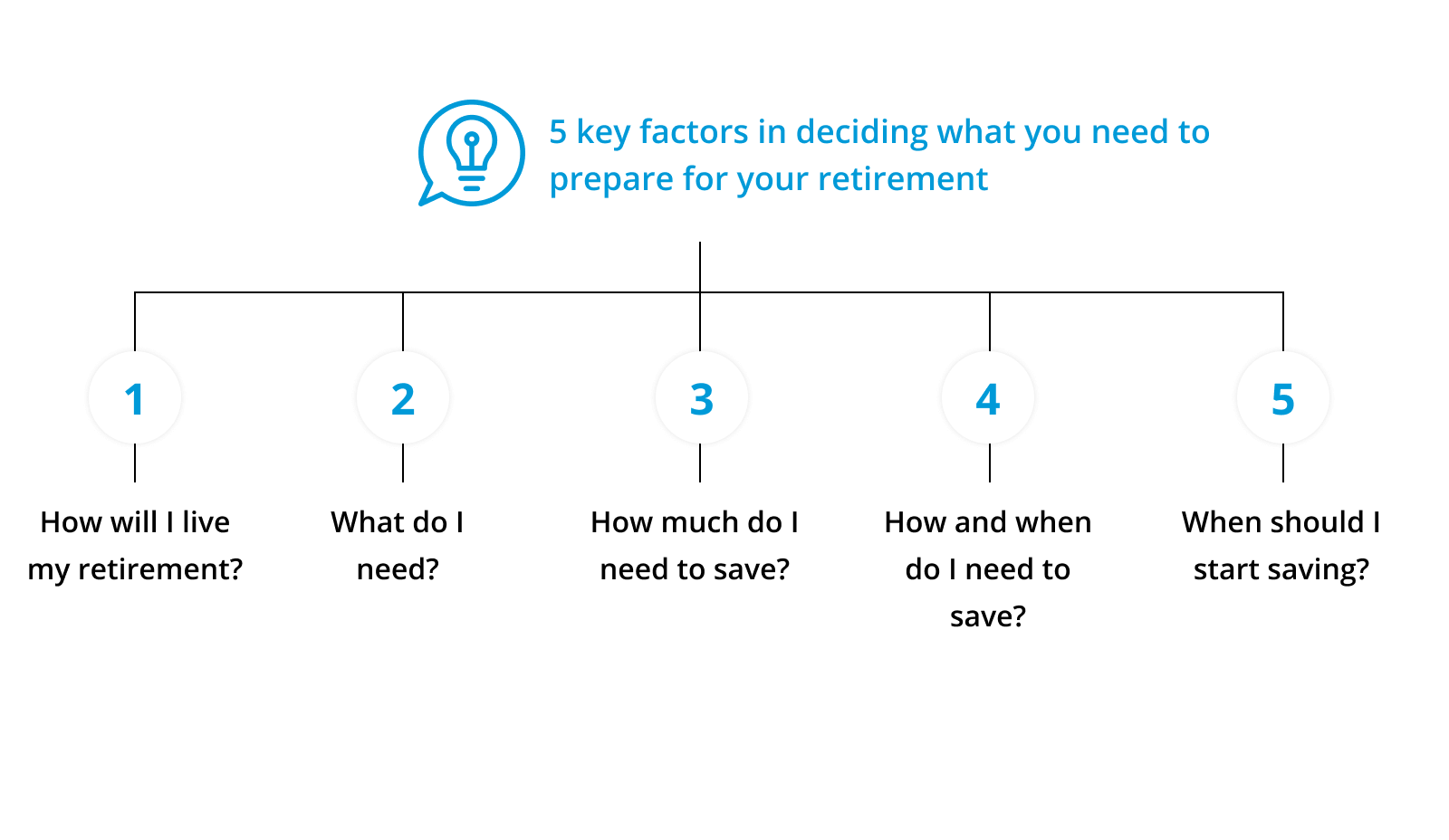

People often wonder where to start when they decide to save. VidaCaixa will give you a few guidelines to help you. These are five key factors in the form of questions to help you analyse what you really need and would like for your retirement.

- How will I live my retirement?

- What do I need?

- How much do I need to save??

- How and when do I need to sav

- When should I start saving?

Pension schemes are an investment alternative that offer income tax benefits. At VidaCaixa, we provide you with solutions for your retirement, so that you can choose the one that best fits your age, needs and investor profile. Some benefits of pension schemes are:

- Flexible contributions. You can decide on the frequency of your deposits to suit your circumstances, whether monthly, quarterly, half-yearly or yearly.

- Tax benefits. Make the most of our products and services: pension schemes are the only type of financial product that is deductible against income ta

- Combine schemes to suit you. Our schemes are not exclusive. You can combine them as you wish if you deposit a maximum of €1,500 per year.

- Transfer your money from another entity. You can transfer money from another entity into any of our schemes, choosing the one that best fits your investor profile.

The future is in your hands, save with the peace of mind that you will be able to have a better life when you retire. At VidaCaixa you can find the pension scheme that best suits your profile. Go to our pension scheme simulator to find the one that best suits you!

Título SEO - Te ayudamos a elegir tu plan de pensiones

Te ayudamos Plan de Pensiones

Categorías relacionadas - titulo

RELATED CATEGORIES

[F20][FAQ Relacionada - Particulares - Pregunta Solución] Do I have enough time for a good retirement - How is a widow's pension calculated?

Categorías relacionadas - carrusel - planes de pensiones - seguros vida - seguros ahorro

[TEXTO SEO]- PREGUNTAS FRECUENTES

Asset Publisher

-

How much should I save every month for my retirement?

-

There isn’t a specific amount to save, but we do advise you to put aside at least 10% of your monthly salary and go increasing it as your salary rises over time.

-

-

What should I do to have a good pension pot?

-

People often ask themselves what to do to have a good pension pot, but there isn’t a specific guide for this. What you really need is the help of an expert advisor or to draw up a plan with a pension scheme early on. We advise you to get going early on. So how do you prepare for your retirement? Some tips are first thinking about how you'd like to live when you retire. Estimate how much pension you’ll receive from the government, taking into account important factors like inflation and your return or risk profile. Look into pension schemes and set up the one that best fits your needs and persevere and be patient to avoid touching the nest egg you’re building for your retirement.

-

-

How long do I need to contribute to the Social Security institution to get 100% of my pension?

-

It depends on how old you are when you retire and the contributions made to the Social Security system during your working life. The retirement age in Spain will increase gradually until 2027, when it will be 67 years. In 2025, the retirement age is 66 years and 8 months if you want to receive 100% of your pension.

-

-

What will happen if I become unemployed or my business closes down?

-

There’s the option of paying the contributions yourself through special agreements with the Social Security authorities to keep being entitled to your pension. Ask one of our advisors or staff members.

-

-

How is the widow/widower’s pension stipulated?

-

The deceased must have been registered with the Social Security institution and paying contributions to it for a certain time. The calculation basis depends on the deceased’s situation (active worker or pensioner) and the cause of their death (common contingency or workplace contingency). Feel free to ask for advice.

-

-

When should I start saving up for my retirement?

-

There isn’t a specific age to start saving up for your retirement. But there is a maximum age accepted and recommended by any advisor: the sooner you start, the better, because it will require far less effort. Therefore, as soon as you have some savings capacity, like for example at 30, you should start saving up or even before if possible.

-

-

How can I retire at 55?

-

Generally speaking, you can’t retire at 55, as you need to reach the minimum age to be entitled to a forced retirement pension, which is four years before the legal retirement age.

-

-

How to get the best pension possible?

-

Firstly, you have to take into account your age, savings and income. We advise you to bear in mind all the keys to getting the best pension possible. Age is a determining factor in receiving your retirement pension, based on the number of years you’ve been paying contributions to the Social Security institution and the increased minimum age. As we know, the higher life expectancy has also meant an increase in the number of years you will be receiving said pension. Also, putting some money aside every month, as if it were a fixed expense, will be essential to build a nest egg that will add to your pension. With time and perseverance, you’ll be able to make those savings work for you and get the best return possible.

-

-

How do I know if I’m entitled to a pension?

-

In order to be eligible for a pension, you must have paid contributions to the Social Security institution and have been working for the minimum time set to receive a pension. You can ask for this information online, through the Social Security website.

-

VidacaixaForm New

Subscribe to our newsletter

You will learn to enjoy the future without worries.